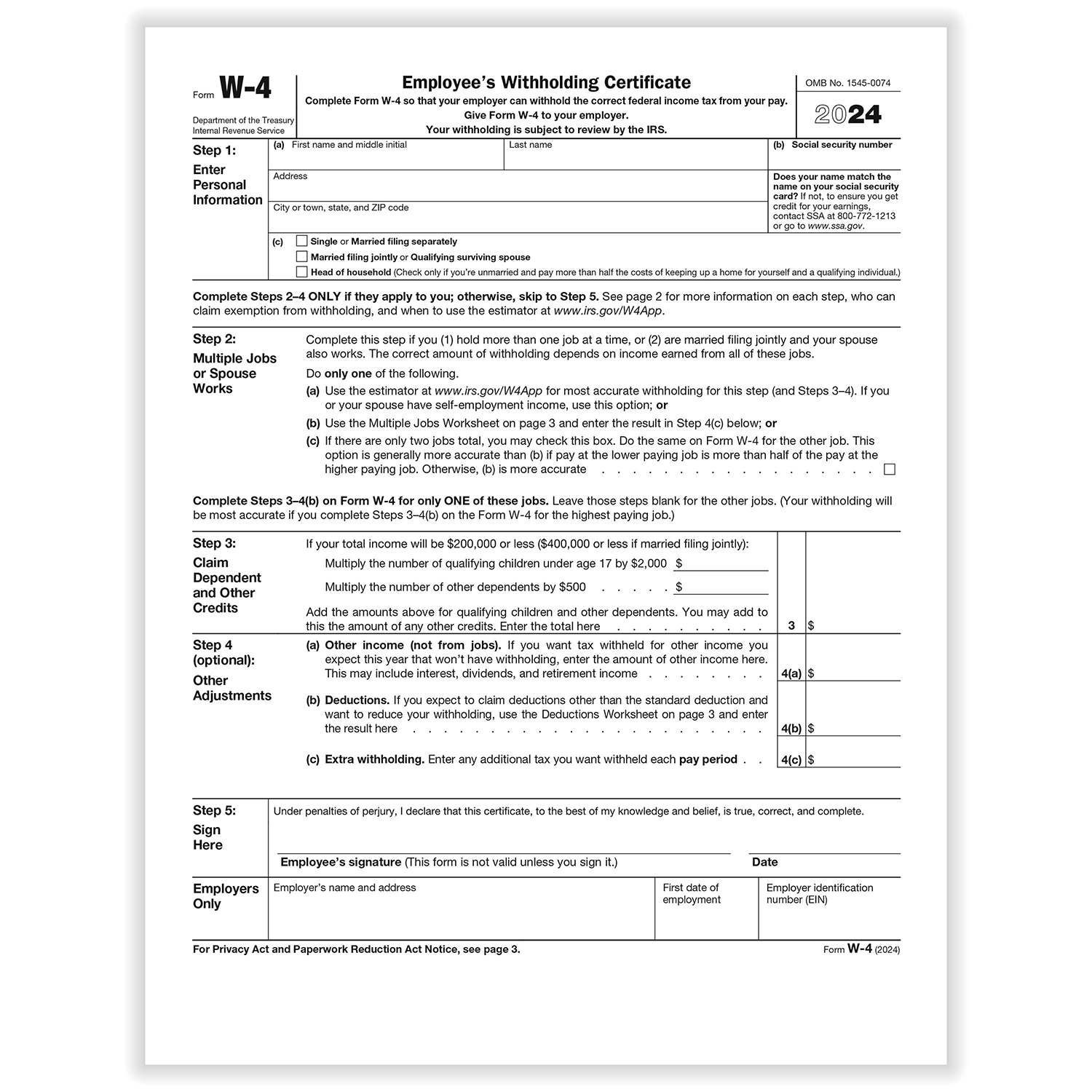

New W 4 Form 2024 – If you work multiple jobs at the same time or are Married Filing Jointly and both you and your spouse are employed, you should fill out a new Form W-4 for each job. • If you work one job or hold . Use our free W-4 calculator to estimate how much to withhold from each paycheck and make the form work for you. Many or all of the products featured here are from our partners who compensate us. .

New W 4 Form 2024

Source : www.irs.govW 4: Guide to the 2024 Tax Withholding Form NerdWallet

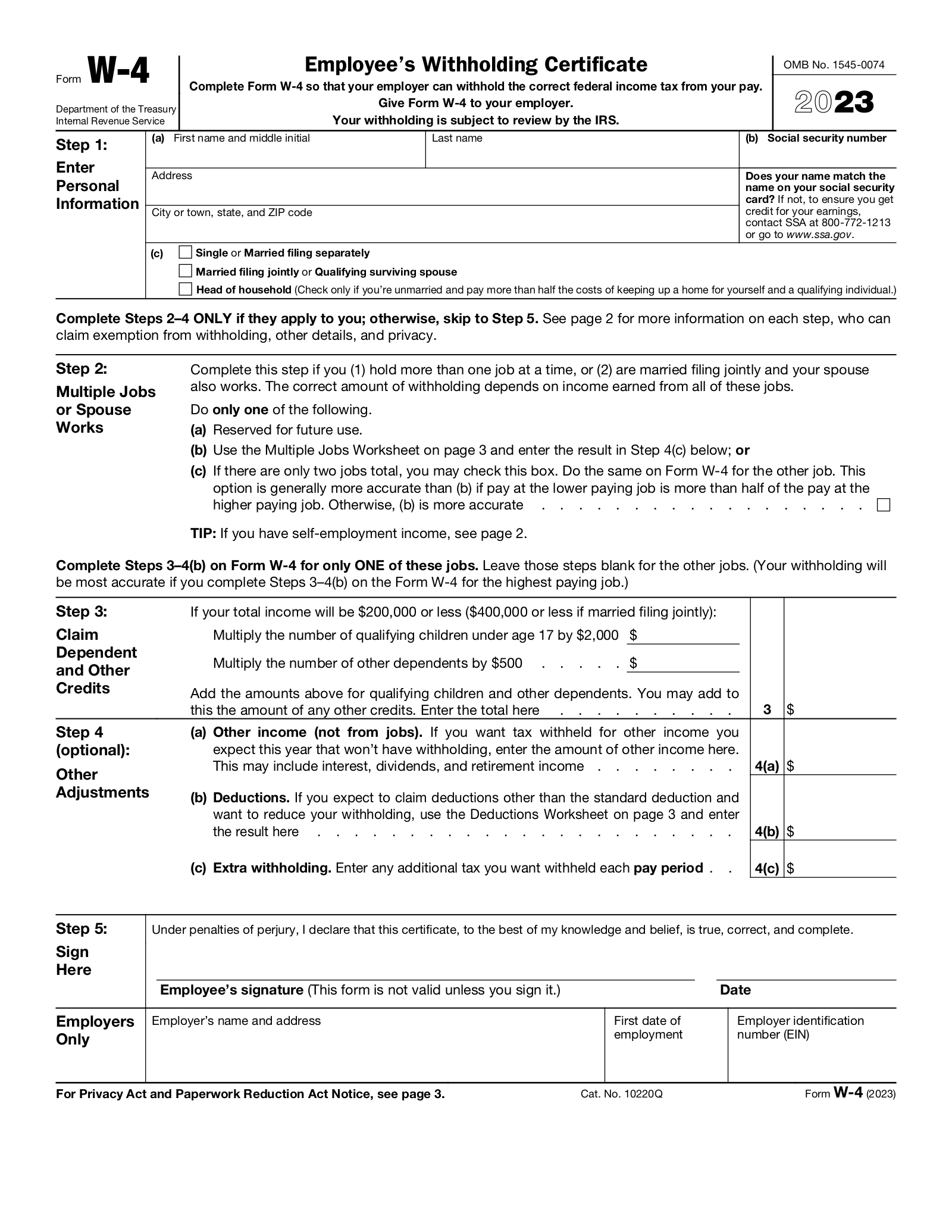

Source : www.nerdwallet.com2024 Form W 4P

Source : www.irs.gov2024 IRS W 4 Form | HRdirect

Source : www.hrdirect.com2024 New Federal W 4 Form | What to Know About the W 4 Form

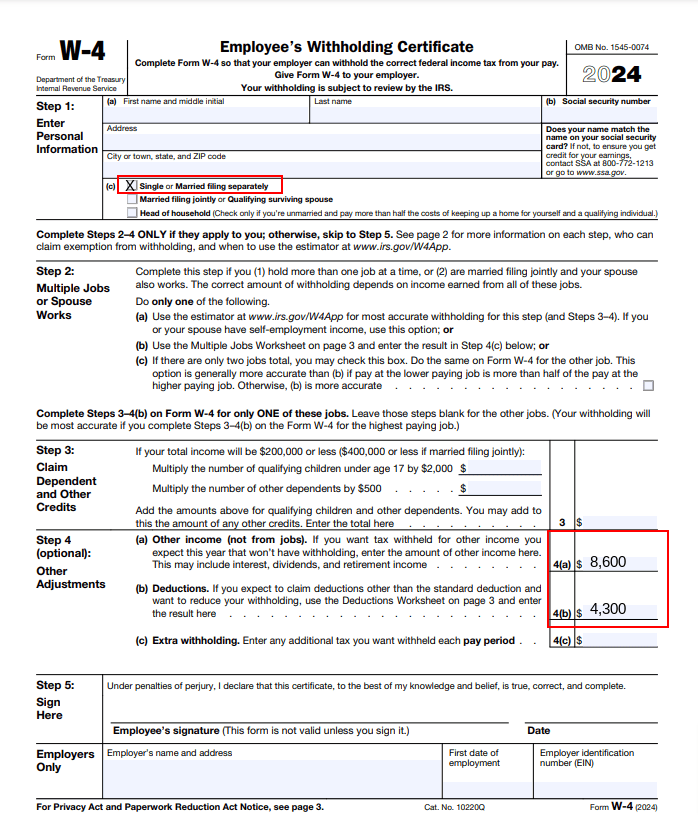

Here’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comIRS Releases 2024 Form W 4R | Wolters Kluwer

Source : www.wolterskluwer.comHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comFree IRS Form W4 (2024) PDF – eForms

Source : eforms.comHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comNew W 4 Form 2024 Employee’s Withholding Certificate: Answer: Yes, once they become available it would be prudent to fill out a new W-4, which have not been made available yet (as of 1/25). The IRS is working on revising the current Form W-4. . How Is Your Paycheck’s Income Tax Withholding Calculated? When you start a new job, you’re required to complete an IRS Form W-4, which is used to determine how much federal income tax and .

]]>